COVID-19 is taking hold across the country and the knock on effect has been dramatic. Asides from the notable human tragedy, schools are closing and businesses are making provisions to trade whilst limiting their contact with other people.

We have been inundated with concerned businesses asking if Business Interruption will cover a forced closure if the Government imposes a ‘shutdown’ on travel and public gatherings.

Business Interruption (BI) cover is designed to be used in conjuction with a material damage claim. This means, in the majority of cases there has to be physical damage to insured property for the BI section to respond.

In some circumstances, there are extensions of cover to include BI as a result of ‘notifiable’ or ‘specified’ diseases. In the former, the insurance includes all notifiable diseases as per Government guidelines. We have pressed insurers to comment on their stance with regards to this and at present, they do not wish to comment on hypothetical situations. Those that insure against ‘notifiable’ diseases will act on a case by case basis. ‘Specified’ disease cover lists certain insured diseases but would likely require proof of an identified case directly causing shut down to the business. With COVID-19 being so new, it is unlikely to be covered under a list of ‘specified’ diseases.

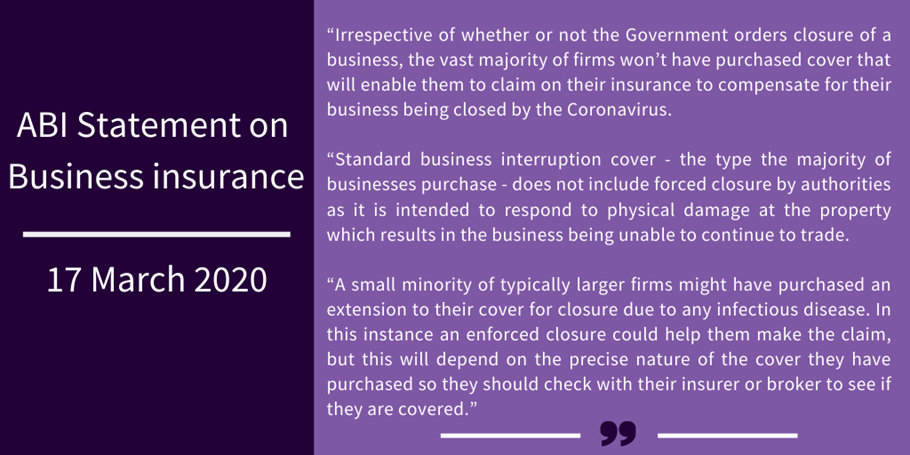

Broadly speaking, any BI cover would not be designed for a Government ‘shutdown’. The wording is likely to apply only when directly involving COVID-19 being contracted at your premises or by your personnel. Even then, proving the disease and associated financial implication to your business would be very difficult. The ABI have confirmed the current insurer stance:

Guidelines on this are changing all the time, but in short your BI cover is unlikely to provide insurance cover for COVID-19 at the time of writing.

If you have any concerns surrounding this matter then please contact your local office or email info@caleb-roberts.co.uk